5 Tips That Work for Losing Weight OR Debt

04/10/2025

By: Conor Moreau

Self-improvement is a never-ending journey, and at times, it can feel overwhelming. It's easy to make excuses for yourself or procrastinate, but what if I told you that some of your goals might actually overlap?

I've been working hard in the gym these past few months, not just because I wanted a killer beach bod by the time we finally said goodbye to all the snow, but because I wanted to feel healthier. A big part of that comes down to dieting, small wins, and other lessons I learned that work just as well when it comes to getting rid of debt!

Real results don't come from quick fixes. It takes planning, consistency, and willpower to stick with it. So, how does managing debt look like losing weight?

#1 - Check the Scale

You might already have a dream weight in mind, but before you start shedding the pounds (OR DEBT!), you have to know EXACTLY where you stand.

Cutting debt involves taking stock of all your outstanding loans and credit cards.

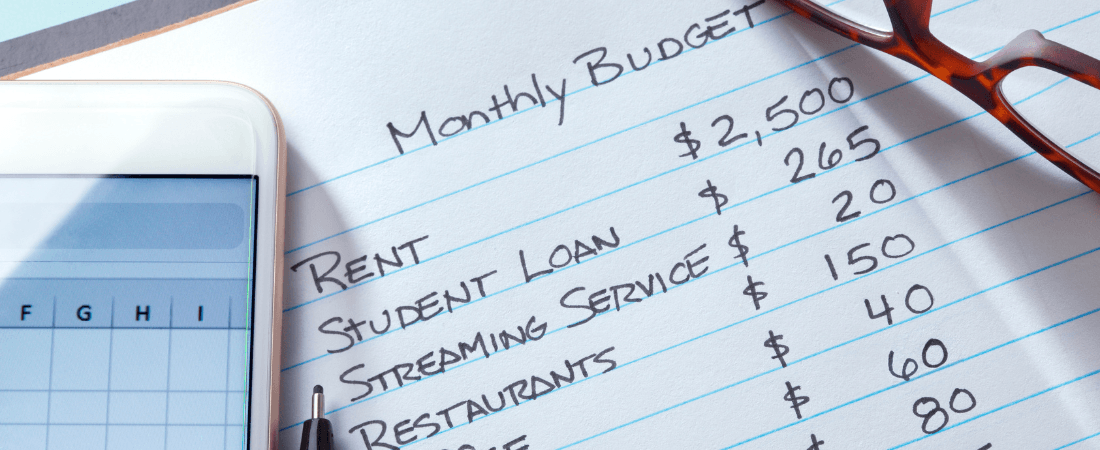

Take time to gather information on all your current debts:

• Who do you owe money to?

• What are the current balances and interest rates?

• What are the minimum monthly payments?

Gaining a clear picture of your current situation is the first step toward taking control. It's helpful to use a simple spreadsheet or budgeting app to list and organize your debts.

#2 - Find a Plan That Works for You

For a plan to work - it needs to be the right fit for you. There is no perfect catch-all diet, workout plan, OR budget. If you're financially struggling or unsure of where to start - check out our previous blog on budgeting: 8 Reliable Tips to Weed Out Bad Financial Habits.

For many people, debt consolidation can be a powerful starting point, like hiring a personal trainer or using a meal plan to kickstart your health goals. This financial tool rolls multiple debts into a new, lower-rate loan. The best part? You'll instantly save money – giving you extra funds each month to pay down debt and providing more wiggle room in your budget.

Debt consolidation might sound complex or time-consuming; however, the process is easy, and the savings are immediate!

#3 - Throw Out Junk Food

Listen, we all have our own kryptonite - for me, it's chips; I could destroy those things without even realizing it. When it's time to go on a debt diet, it's important to keep your financial temptations in check.

When you consolidate debt, your existing credit card balances are typically paid off and transferred to a new loan – leaving you with $0 balances on each card. Many find it challenging to resist using those cards again, ultimately racking up more debt.

Once you consolidate debt:

• Put away your old credit cards (take them out of your wallet).

• Avoid making impulse purchases.

• Create a budget that keeps your spending in check.

It's also helpful to delete saved credit cards from online shopping sites. If you find the temptation to spend on these cards too great, close the accounts to eliminate the urge to spend.

#4 - Keep Track

You shouldn't hyper-obsess - it'll drive you nuts. You should know how you're doing; check in when you get the chance. Maybe that's tracking your spending or setting aside time each week to check your balances. You don't need to count every macro or financial calorie, but taking charge of your financial health requires you to hold yourself accountable.

Remember, don't get discouraged if you make a mistake or face a setback. Pick yourself up and keep moving forward.

#5 - REMEMBER TO CELEBRATE YOUR WINS!

Everything is a process - you won't magically solve all your issues tomorrow. It takes time and hard work, and when that hard work materializes into little wins, you need to take the time to celebrate them.

Losing five pounds is a big deal – so is paying off a credit card or reaching a new payoff milestone! Remaining motivated on your debt journey means recognizing and celebrating progress along the way.

We're Here to Help!

You don't get fit in a day – and you won't become debt-free overnight. However, with the right plan, consistent effort, and a little support, you can lighten your financial load and feel more in control of your future. Taking the first step is the hardest and most important part of becoming debt-free. And we're here to walk with you throughout the entire process.

If you want to learn more about debt consolidation or are curious about how much you can save, we're ready to help. Please stop by any of our convenient branch locations or call 800-834-0432 to schedule an appointment today.

Stay up to date and join our email list.

The Atlantic blog strives to deliver informative, relevant, and sometimes fun financial information. If you enjoyed this article, please forward it to a friend.

Each individual’s financial situation is unique and readers are encouraged to contact the Credit Union when seeking financial advice on the products and services discussed. This article is for educational purposes only; the authors assume no legal responsibility for the completeness or accuracy of the contents.