Easy Ways to Avoid Bumps in Your Credit Journey

10/24/2024

By: Conor Moreau

Pack a bag, grab a snack, and prep for any weather – we're going on a credit score journey.

Everyone's credit score journey starts somewhere – maybe yours began with a student loan, car payments, or rent. No matter where you started, you took the important first step toward growing your credit score – you went into debt.

We're accustomed to thinking of debt as a negative thing, a black mark on your report card of life – but it's important to shed those antiquated ideas – a little debt is a good thing.

Knowing how to utilize debt to grow your credit score is an essential tool in your financial arsenal, but before we get into that, let's make a quick pit stop.

Where does this all come from?

That's a bit of a pointed, open-ended question – we could delve deep into the origination of credit scores, but this isn't a history lesson, and we're doing our best to avoid naps on our journey.

Think of your credit score as the score a teacher gives on a class's final – getting a big red F at the top of your test won't flunk you out of school, but it will make graduating a bit more difficult.

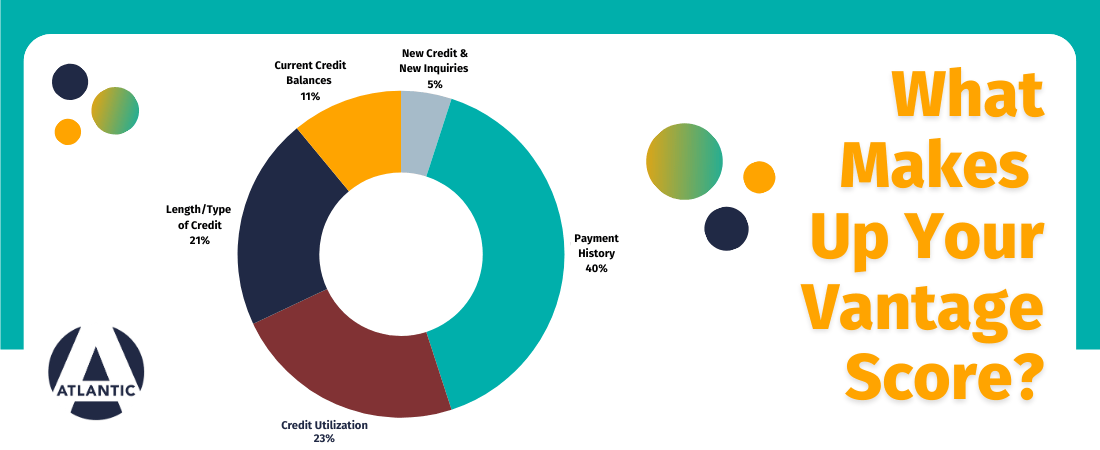

Your score is calculated by a series of different scoring models that each hold different weights – here at Atlantic, we use the Vantage 4.0 scoring model.

Just by taking a glance at what the Vantage 4.0 score model takes into consideration, you might already have an idea of how you can improve your credit. Remember, the better your credit score, the higher your likelihood of achieving your financial goals.

WHAT ARE MY GOALS?

It’s time to break out the snacks.

Look, there’s no right or wrong answer to the question; there’s only YOUR answer. I’ve been thinking of buying a new car, one that’s more gas-efficient when commuting in the morning. To do that, I want to make sure my credit score is as high as I can make it so I can secure a better loan.

A better credit score will allow you to secure lower interest rates and more credit capacity and open up your financial options.

So, what are your goals? When you’re done munching on your snack, take out a piece of paper and write it down. Do you want to buy a house? Go on a trip? Make a big financial change in your life?

Hang up the note on your wall somewhere where it’ll be top of mind and remember that THIS is why you’re on a credit journey. It’s what you’re working towards. It won’t happen tomorrow, and yeah, there might be some setbacks along the way – but you’re working towards it. You’re taking control of your journey.

LET’S IMPROVE TOGETHER

Okay, so we have our goals, but how are we going to reach them? Well, we know how the Vantage Score Model calculates credit scores, so let’s start there:

- Never Miss a Payment. It sounds obvious, but making sure that your payment history remains as spotless as possible can drastically improve your overall scores – and chances of securing a loan. Setting up automatic loan payments can help make sure you never miss a payment due date again!

- Reduce your debt. We talked about having a little bit of debt, but having too much can be a ding against you. If you’re struggling to pay down credit cards or lingering loans – consider applying for debt consolidation. Not only will it help your credit score, but it will also provide you with a convenient single monthly payment, so you don't have to keep track of multiple credit cards or loans.

- Wait. Payment history holds a great deal of weight, and if you continue to never miss a payment and show that you can handle and pay off the debt loaned to you, you’ll naturally improve your credit score.

- Regularly check your score and credit report. Don’t become obsessive but do keep track of your score. Try to check it once a month with SavvyMoney in our Digital Banking app so you can see what’s been positively and negatively impacting your score and you can adjust accordingly.

- Avoid taking on new debt. If you’re working toward your goal, try to avoid adding new debt to your finances – debt is good, but too much debt can leave your score wounded and make it harder for you to secure a new card, loan, or whatever your goal might be.

Showing lenders that you can take on debt – and regularly pay it off- helps create a strong history that reinforces that you can be trusted to take on more. If your utilization of your debt capacity is high, it will negatively impact your score.

WHAT’S MY DEBT CAPACITY?

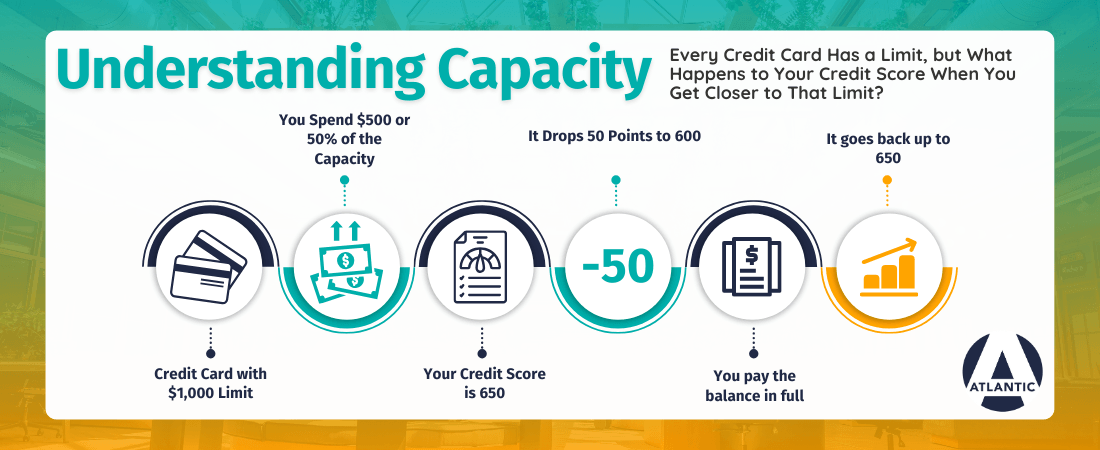

If you’ve sat in on one of our Credit Score Seminars before, you might have heard Leya, Atlantic’s Consumer Loan Manager, describe capacity before. She’s an expert at breaking it down for the rest of us.

“Capacity makes up a BIG part of our credit score. Capacity is all about how much you have in total credit card limits. So, for example, If you have a credit card with a $1000 limit and you spend $500 you’ve used half, or 50%, of your total capacity.

“What does this mean for your credit score? You will lose about 50 points off of your score – for using 50% of your total capacity. If you had started with a 650-credit score – by spending $500, you could have dropped your score to 600!

The good news about capacity is that once you pay that balance back down, your score will quickly go back up those same 50 points. Paying down your credit card balances is the fastest way to improve your credit score!!”

Thanks, Leya! You put it better than I ever could have. Want a simple way to improve your credit score? Well, there you go – keep your utilization of your credit capacity low, use debt responsibly, and keep on working towards your goals!

Now it’s time I said goodbye; you’ve got to keep on traveling your credit score journey on your own, but don’t worry if you want to learn even more about credit scores; I’ve got a parting gift for you.

Leya shares even more of her expertise in our 2024 Credit Score Seminar and it’s FREE. Your credit score loooves free.

Remember: You can check your credit score with SavvyMoney in Atlantic’s App or in Online Banking WHENEVER you want.

Checking your score with SavvyMoney will never negatively impact your score, AND you can set up monitoring alerts to keep you informed of changes.

We’re Here to Help!

Everyone has a unique credit journey shaped by their life experiences, and it’s important not to get lost comparing yourself to others; instead, focus on how you can overcome your credit obstacles and continue to improve your score. I know you can achieve your goals.

Even modest gains can land you in a better credit tier and reduce how much interest you will pay.

If you have questions about your credit score or are curious about how much you could save through debt consolidation, we’re prepared to help. Please stop by any of our convenient branch locations or call 800-834-0432 to speak with a team member today.

Stay up to date and join our email list.

The Atlantic blog strives to deliver informative, relevant, and sometimes fun financial information. If you enjoyed this article, please forward it to a friend.

Each individual’s financial situation is unique and readers are encouraged to contact the Credit Union when seeking financial advice on the products and services discussed. This article is for educational purposes only; the authors assume no legal responsibility for the completeness or accuracy of the contents.