Class is in; it's Time to Learn HELOC Fundamentals.

08/21/2025

Home sweet home isn't just a roof over your head, it's also equity that can help you achieve your…

Read More

Hit the Road Now: Tips for Budget-Friendly Summer Road Trips

08/07/2025

Feeling the summer heat? Maybe it's time for a little getaway. Road trips can turn stressful in a…

Read More

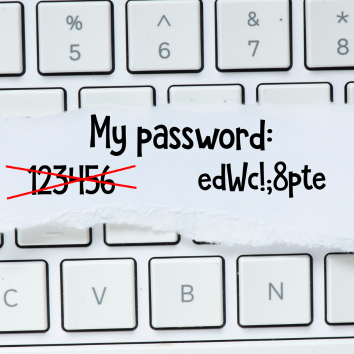

The Foundation of Good Security? Strong Passwords

07/24/2025

Please, please don't tell us your password is Password123. Account security is a huge concern -…

Read More

Unlock Better Rates - Get Life Insurance While You're Young

07/17/2025

Life insurance isn't just for families or older adults - it's a smart move for anyone looking to…

Read More

You're an Adult Now, Let's Make It Less Scary

06/26/2025

No matter what age you are, you're probably still figuring out life. So, even if you're 99 years…

Read More

How to Love Vacationland: Summer Vibes on a Budget

06/05/2025

The sun is shining, the birds are singing, and it's got you thinking, "What AM I going to do this…

Read More