Vacationland Year Round - Atlantic Staff's Favorite Maine Fun

05/02/2025

They might call Maine Vacationland, but for those of us who call this state home, there's fun to be…

Read More

Stay Safe: Top Fraud Trends of 2025 You Need to Know

04/25/2025

Knowledge is only half the battle but knowing what to look out for should help prepare you if a…

Read More

5 Tips That Work for Losing Weight OR Debt

04/10/2025

Self-improvement is a never-ending journey, and at times, it can feel overwhelming. It's easy to…

Read More

You're an Adult Now, Let's Make It Less Scary

06/26/2025

No matter what age you are, you're probably still figuring out life. So, even if you're 99 years…

Read More

How to Love Vacationland: Summer Vibes on a Budget

06/05/2025

The sun is shining, the birds are singing, and it's got you thinking, "What AM I going to do this…

Read More

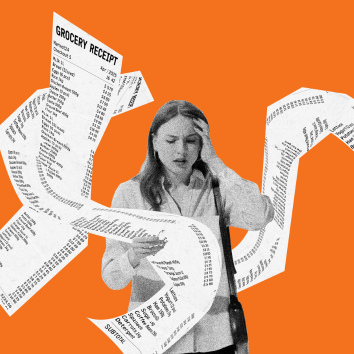

Buy Now, Pay Later: Smart Hack or Deadly Trap?

05/15/2025

As prices skyrocket higher and higher, and people struggle to afford things, companies push Buy Now…

Read More